Legal Compliance Calendar for June 2016: Every business consultant, business person and their legal and compliance department are always on guard that they fulfill all the regulatory filing on time. So solve this problem we have compiled the different due date for legal filing under different act like Income Tax Act 1961, Service tax laws, Central Excise and Custom, Companies Act 2013, provident Fund, Employee State Insurance Corporation or Value Added Tax etc.

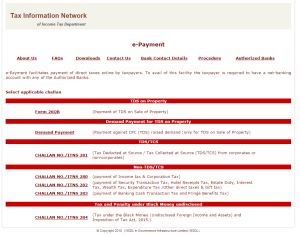

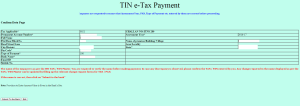

Income Tax Compliance for June 2016

- 7th June – Due for payment of TDS/TCS for May’2016

- 15th June- Last date for first installment of advance Income tax for Assessee having tax liability more than Rs. 10000/- and

- 15th June – Issuance of TDS certificate for other than salary for quarter 1 i.e. for TDS return filed for Period January to March 2016 due date for same was 15 May 2016 same has been to changed to 30 May for next year

Rules and Guidelines for Income Tax Compliance

A. For companies

- TDS deducted during May’2016 due for payment on 07.06.16.

- Advance tax for FY 16-17 First instt of 15% due on 15/06/2016

- Issue TDS certificate for Q1 for other than salary by 15/06/16 and TCS certificate by 30/05/16

B. For firm and individual covered under tax audits

- TDS deducted in May’ 2016 payment due on- 07.06.2016.

- Advance tax to be paid 15% ( first installment) of tax liability till 15/06/2016

- Issue TDS certificate for quarter ending 31st March 2016 for other than salary by 15/06/16 and TCS certificate by 30/05/2016

- Annual information statement due date 31/05/2016

Central Excise and Custom Compliance for June 2016

- 6th June- Due date for payment of excise for the month of May’2016

- 10th June – Last date for excise return for the month of May’2016 – Due Date for ER-1

Rules and Guidelines for Central Excise Compliance

- Excise registered units as Small Scale Industry – No payment and no return due this month of June but Unit Registered as Non SSI units – Last date for payment for the month of May is 06.06.2016 and for return 10.06.2016

Service Tax Compliance for June 2016

- 6th June- Due date for payment of service tax for the month of May’2016 for other than Individual, Partnership firm and HUF as they have deposit service tax on quarterly basis.i.e Companies has to deposit service tax on monthly basis in case

VAT Tax Compliance for June 2016

- 14th June- Last date for payment of Rajasthan VAT liability for dealer covered under monthly tax liablity.

- 14th June – Last date for Works Contract Tax TDS is for May 2016

- 15th June – Last for Monthly return for Composition Dealer under Karnataka VAT

- 15th June – Last date for TDS deposit for previous month under Delhi VAT

- 20th June – Last date for monthly return or statement for tax deducted at source under KVAT using VAT – 100, VAT – 110 , VAT – 125, VAT–126, VAT-127

- 21st June -Last date for payment of MVAT liability.

- 29th June- Last date for filing of VAT 11 annual return for the Year 2015-16 in Rajasthan VAT

- 30th June – Due Date filing return half yearly return for October to March (For dealers not liable to file F-704 under Maharashtra VAT

- 30th June – Person who stands enrolled before the commencement of a year or is enrolled on or before 31st May of a year under under Profession Tax Act 1975 for Profession Tax Enrollment Certificate (PTEC) holder Maharashtra

Provident Fund and ESIC Compliance for June 2016

- 15th June – last date for payment of Provident fund liability Due Date date for Provident fund Contribution, government has removed the grace period of 5 days from February 2016.

- 21st June- Last date for payment of ESIC liability for May 2016.

- 25th June- Last date for filing of PF return for the month of May

Corporate Law and LLP Compliance

30th June – Extended Last date for return of LLP for FY- 2015-16

Summary Date-wise Compliance under different rules and regulation

- 6th June- Due date for payment of excise and service tax for the month of May’2016

- 7th June – Due for payment of TDS/TCS for May’2016

- 10th June – Last date for excise return for the month of May’2016

- 14th June- Last date for payment of RAJ VAT liability.

- 14th June – Last date for WCT TDS is for May’2016

- 15th June – last date for payment of Provident fund liability

- 15th June- Last date for first installment of advance Income tax for Assessee having tax liability more than Rs. 10000/- and issuance of TDS certificate for other than salary for quarter 4 for FY 2015-16

- 20th June – Different VAT return under Karnataka VAT

- 21st June – MVAT last Date of Payment

- 21st June- Last date for payment of ESIC liability for May 2016.

- 25th June- Last date for filing of PF return for the month of May

- 29th June- Last date for filing of VAT 11 annual return for the Year 2015-16 in RAJ VAT

- 30th June – Extended Last date for return of LLP for FY- 2015-16