Requirement of the section 10(13A) is that any allowance (by whatever name called) granted to an assessee by his employer to meet expenditure actually incurred on payment of rent in respect of residential accommodation occupied by the assessee, to such extent as may be prescribed.

However, the exemption is not available in case the residential accommodation occupied by the assessee is owned by him or the assessee has not actually incurred expenditure on payment of rent (by whatever name called) in respect of the residential accommodation occupied by him.

Admittedly, the AO has given a finding of fact that the assessee and his wife are living together as a family. Therefore, it can be inferred that the house owned by wife of the assessee is occupied by the assessee also and in remand report it has been submitted that the assessee has submitted the rent receipt(s) of Rs.15,000/- dated 3.7.2008 and Rs.1,65,000/- dated 31.3.2009 and stated that the payments have duly been paid through bank transfer entry. A verification of the said entry shows the transfer on the given dates but the receipts date and amount of Rs.1,65,000/- not reflecting as transfer.

Therefore, in our considered opinion, the assessee has fulfilled twin requirements of the provision, i.e. occupation of the house and the payment of rent. Under these circumstances, the assessee is entitled for exemption u/s.10(13A) of the Act. Since we have observed that the ld.CIT(A)’s chose not to make enhancement and disallow the relief u/s.24 of the Act, therefore we cannot comment upon this aspect of the matter. In this view of the matter, we delete the addition and direct the AO to allow exemption u/s.10(13A) of the Act to the assessee. This ground is also allowed as indicated above.

INCOME TAX APPELLATE TRIBUNAL, AHMEDABAD

BEFORE SHRI A.MOHAN ALANKAMONY,ACCOUNTANT MEMBER And

SHRI KUL BHARAT, JUDICIAL MEMBER

I.T.A. No.715/Ahd/2013 – Assessment Year : 2009-10)

Bajrang Prasad Ramdharani Vs. Asst.CIT

Date of Hearing : 28/6/2013

Date of Pronouncement : 12/07/2013

O R D E R

PER SHRI KUL BHARAT, JUDICIAL MEMBER :

This appeal by the assessee is directed against the order of the Commissioner of Income Tax (Appeals)-XXI-Ahmedabad (‘CIT(A)’ for short) dated 27.12.2012 for Assessment Year 2009-10.

2. Facts in brief are that the case of assessee was picked up for scrutiny assessment and the assessment was framed u/s.143(3) Income Tax Act, 1961 (hereinafter referred to as “the Act”). The Assessing Officer (AO) has made various additions on account of short- tem capital gain, disallowance of interest claimed u/s.24, disallowance of exemption u/s.10(13A) and addition u/s.68 of the Act. The assessee feeling aggrieved by this order, filed an appeal before the ld.CIT(A) who after considering the submissions of the assessee, partly allowed the appeal.

3. While allowing the appeal, ld.CIT(A) confirmed the addition of Rs.42,371/- in respect of the disallowance of interest and the disallowance u/s.10(13A) of Rs.1,11,168/-. Against these two confirmation of additions, the assessee is further in appeal before this Tribunal.

4. The first ground relates to the disallowance of Rs.42,371/- being disallowance of interest while computing the capital gain from sale of house-property. The Ld.counsel for the assessee submitted that the ld.CIT(A) erred in confirming the addition. Ld.counsel for the assessee submitted that admittedly this amount pertained to previous year and the interest being related to the pre-construction period on borrowed capital. She submitted that the interest on borrowed capital of pre-construction period is allowable u/s.24(b) of the Act. She further submitted that since the property was sold, therefore this pre-construction interest period should form part of the cost of acquisition of property. She submitted that alternatively this interest amount is allowable u/s.24(b) of the Act. In support of her contention about pre-construction period, interest ought to have been allowed as a cost of acquisition of property and relied on the decision of Hon’ble High Court of Madras rendered in the case of CIT vs. K.Raja Gopala Rao reported at [2001] 252 ITR 459 (Mad.) and also the decision of Hon’ble High Court of Karnataka rendered in the case of CIT vs. Sri Hariram Hotels (P.) Ltd. reported at [2010] 325 ITR 136 (Kar.).

4.1. On the contrary, ld.Sr.DR supported the orders of the authorities below and submitted that this amount cannot form part of the cost of acquisition as the assessee himself has claimed it as an interest of pre- construction period.

5. We have heard the rival submissions, perused the material available on record and the judgements relied upon by the Ld.counsel for the assessee. We find that the AO disallowed this claim of the assessee without assigning any reason and the ld.CIT(A) has simply confirmed the amount without assigning reason as to how this amount is not admissible. The contention of the counsel is that the assessee has paid interest on borrowed capital for construction of house to City Bank of Rs.52,964/- which was related to pre-construction period. The assessee has claimed this interest as part of cost of construction and accordingly claimed in the return of income. It is further submitted that the interest expense related to pre-construction period either can be added to cost of construction or can be claimed 1/5th every year. The assessee has claimed the interest as part of cost of construction and assessee could avail the deduction only once and, therefore, the unabsorbed interest of Rs.42,371/- shall become part of the cost of the property. It is also submitted that this cost towards unabsorbed interest should be considered as cost of acquisition of property and allowed to be deducted at the time of sale of the property. Alternatively, it is submitted by the Ld.counsel for the assessee that even if adverse view is taken deduction u/s.24 of the Act is allowable. So far the contention of the assessee is concerned that this amount is required to be treated as cost of acquisition of granting deduction qua the interest on borrowed capital related to pre-construction period is allowable u/s.24(b) of the Act. However, this claim of the assessee would be allowable u/s.24(b) of the Act, therefore, in our considered opinion, the assessee is entitled for deduction u/s.24(b) of the Act. The AO is directed accordingly and the addition is hereby deleted. This ground of appeal is allowed.

6. Now coming to the second ground which relates to the disallowance of exemption u/s.10(13A) of the Act of Rs.1,11,168/- for house rent allowance. Ld.counsel for the assessee submitted that the assessee claimed deduction u/s.10(13A) of the Act amounting to Rs.1,11,168/- in respect of house rent allowance and the authorities below grossly erred in not allowing the exemption. She further submitted that a bare reading of the provision would make it ample clear that the assessee is entitled for exemption u/s.10(13A) of the Act. She submitted that in support of the expenditure of house rent, requisite details and evidences were filed before the ld.CIT(A) who had called for a remand report from the AO. She submitted that the reasoning given by the AO and the ld.CIT(A) are different in disallowing the exemption.

6.1. On the contrary, Sr.DR for the Revenue supported the orders of the authorities below. Sr.DR pointed out that the AO in the remand report has submitted that the assessee has claimed the house owned by him as self-occupied and therefore, the authorities below were justified in disallowing the claim of the assessee.

7. We have heard the rival submissions, perused the material available on record and the orders of the authorities below. We find that the AO disallowed the claim of the assessee on the ground that the assessee has not given details of payment and evidences and also on the basis that the assessee and his wife are living together, hence the claim of payment of rent is just to avoid payment of taxes and to reduce the tax liability. Ld.CIT(A) confirmed the addition on the ground that the rent is paid by the assessee as a tenant to his wife who is a landlord and he found that the landlord and tenant are living together in the same house- property and the very fact that the landlord and tenant are staying together which indicates that the whole arrangement is of the nature of colourable device as pointed out by the AO. He observed that since it is evidently a colourable device, even though the amount purportedly paid as a rent will not qualify for exemption u/s.10(13A). The AO and CIT(A) have disallowed the claim of the assessee on the ground that assessee and his wife are living together but not on the ground that in return of income a house owned by him is declared as a self-occupied, however, we find a mention in the remand report (annexed at page-61), where the AO has commented that it is not ascertainable whether the assessee stayed with his wife’s house or at his own house which he claimed self occupied and claimed the relief u/s.24 of the Act. Under these circumstances, we have to only examine whether the assessee is entitled for exemption u/s.10(13A) or not. For the sake of clarity, section 10(13A) is reproduced hereinbelow:-

Section 10(13A):-

(13A) any special allowance specifically granted to an assessee by his employer to meet expenditure actually incurred on payment of rent (by whatever name called) in respect of residential accommodation occupied by the assessee, to such extent as may be prescribed having regard to the area or place in which such accommodation is situate and other relevant considerations.

Explanation.-For the removal of doubts, it is hereby declared that nothing contained in this clause shall apply in a case where-

(a) the residential accommodation occupied by the assessee is owned by him; or

(b) the assessee has not actually incurred expenditure on payment of rent (by whatever name called) in respect of the residential accommodation occupied by him;

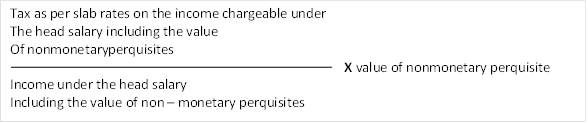

7.1. From the reading of the above section, it is clear that the requirement of the section is that any allowance (by whatever name called) granted to an assessee by his employer to meet expenditure actually incurred on payment of rent in respect of residential accommodation occupied by the assessee, to such extent as may be prescribed. However, the exemption is not available in case the residential accommodation occupied by the assessee is owned by him or the assessee has not actually incurred expenditure on payment of rent (by whatever name called) in respect of the residential accommodation occupied by him. Admittedly, the AO has given a finding of fact that the assessee and his wife are living together as a family. Therefore, it can be inferred that the house owned by wife of the assessee is occupied by the assessee also and in remand report it has been submitted that the assessee has submitted the rent receipt(s) of Rs.15,000/- dated 3.7.2008 and Rs.1,65,000/- dated 31.3.2009 and stated that the payments have duly been paid through bank transfer entry. A verification of the said entry shows the transfer on the given dates but the receipts date and amount of Rs.1,65,000/- not reflecting as transfer. Therefore, in our considered opinion, the assessee has fulfilled twin requirements of the provision, i.e. occupation of the house and the payment of rent. Under these circumstances, the assessee is entitled for exemption u/s.10(13A) of the Act. Since we have observed that the ld.CIT(A)’s chose not to make enhancement and disallow the relief u/s.24 of the Act, therefore we cannot comment upon this aspect of the matter. In this view of the matter, we delete the addition and direct the AO to allow exemption u/s.10(13A) of the Act to the assessee. This ground is also allowed as indicated above.

8. In the result, appeal of the assessee is allowed. Order pronounced in Open Court on the date mentioned hereinabove

Ahmedabad; Dated 12/ 07 /2013