Legal Compliance Calendar for July 2016: Every business consultant, business person and their legal and compliance department has to fulfill different regulatory filing on time. So to solve this problem we have compiled the different due date for legal filing under different act like Income Tax Act 1961, Service tax laws, Central Excise and Custom, Companies Act 2013, Provident Fund, Employee State Insurance Corporation or Value Added Tax i.e. different VAT Acts in India etc.

Income Tax Compliance for July 2016

- 7th July – Due for payment of TDS/TCS for July’2016

- 31st July – Filling of TDS return for period April to June 2016 and TDS certificate has to been issued within 15 days of Filling of TDS return i.e. 15 August 2016. Previously due date for filling quarterly TDS return was 15 July.

- Due for Filling Annual Income Tax Return for Individual and HUF. Individual having only salary Income Tax can file ITR 1 and Business not under audit can file ITR 4S or ITR 4 by 31 July 2016.

Rules and Guidelines for Income Tax Compliance

A. For companies

- TDS deducted during June 2016 due for payment on 07.07.16.

- Filling of Quarterly TDS return by 31st July 2016.

B. For firm and individual covered under tax audits

- TDS deducted in June’ 2016 payment due on- 07.07.2016.

- Filling of Quarterly TDS return by 31st July 2016.

Central Excise and Custom Compliance for July 2016

- 6th July- Due date for payment of excise for the month of June’2016

- 10th July – Last date for excise return for the month of June’2016 – Due Date for ER-1

- 20th July – Last date for excise return for the Quarter ending June’2016 i.e. April to June 2016 – Due Date for ER-1 for Excise registered units as Small Scale Industry

Rules and Guidelines for Central Excise Compliance

- Excise registered units as Small Scale Industry – Payment due date is 15th July 2016 and Return due date of 1st quarter ending 30th June 2016 is 20th July 2016 but Unit Registered as Non SSI units – Last date for payment for the month of June is 06.07.2016 and for return 10.07.2016

Service Tax Compliance for July 2016

- 6th July- Due date for payment of service tax for the month of June’2016 for other than Individual, Partnership firm and HUF as they have deposit service tax on quarterly basis.i.e Companies has to deposit service tax on monthly basis in case

- 6th July 2016 – Due date for payment of service tax for the period April to June 2016 i.e. Quarter 1 of FY 2016-14 for Individual, Partnership firm and HUF as they have deposit service tax on quarterly basis.

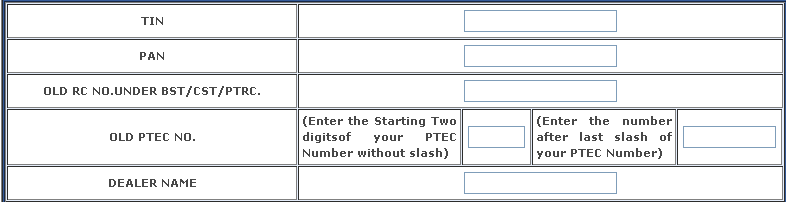

VAT Tax Compliance for July 2016

- 12th July – Last Date or Due Date of Payment of VAT Liability for June 2016 for business having turnover of more than Rs 200 cr in previous year under TNVAT (Tamil Nadu VAT)

- 14th July- Last date for payment of Rajasthan VAT liability for dealer covered under monthly tax liability.

- 14th July – Last date for Works Contract Tax TDS is for June 2016

- 15th July – Last for Monthly return for Composition Dealer under Karnataka VAT

- 15th July – Last date for TDS deposit for previous month under Delhi VAT

- 20th July – Last date for monthly return or statement for tax deducted at source under KVAT using VAT – 100, VAT – 110 , VAT – 125, VAT–126, VAT-127

- 20th July – Due Date or Last Date of Payment of VAT Liability for Month and Quarter ending June under UP VAT (Uttar Pradesh VAT rule 43)

- 20th July – Due Date for Payment of VAT Liability under Tamil Nadu VAT Act.

- 21st July -Last date for payment of Maharashtra VAT liability.

- 21st July – Last date for payment of Delhi VAT liability for Month ending 30th June and for Quarter April to June 2016

- 21st July – Last date for payment of MVAT liability for Quarter 1 (April to June).

- 25th July – Last date for Filling of Delhi VAT return for Quarter ending June 2016

- 25th July – Last date of payment of VAT Liability under Bihar VAT Act

- 31st July – Last Date of Filling of Quarterly return under Bihar VAT Act

- 31st July – Last date of Filling Annual Return under Bihar VAT for Compounding Dealer

Provident Fund and ESIC Compliance for July 2016

- 15th July – last date for payment of Provident fund liability, Due Date date for Provident fund Contribution, government has removed the grace period of 5 days from February 2016.

- 21st July- Last date for payment of ESIC liability for June 2016.

- 25th July- Last date for filing of PF return for the month of June

Summary Date-wise Compliance under different rules and regulation

- 6th July- Due date for payment of excise and service tax for the month of June’2016

- 7th July – Due for payment of TDS/TCS for June’2016

- 10th July – Last date for excise return for the month of June’2016

- 14th July- Last date for payment of RAJ VAT liability.

- 14th July – Last date for WCT TDS is for June’2016

- 15th July – last date for payment of Provident fund liability

- 20th July – Different VAT return under Karnataka VAT

- 21st July – MVAT last Date of Payment

- 21st July- Last date for payment of ESIC liability for June 2016.

- 25th July- Last date for filing of PF return for the month of June

- 31st July- Last date for filing of Annual Income Tax return for Individual in ITR 1, ITR 4, ITR4S

- 31st July – Last date for filling Quarterly TDS return under Income Tax.