CBDT extended the time-limit for filing ITR-V for Assessment years 2009-10, 2010-11 and 2011-12 till 31.03.2014 returns-of-income which were electronically filed without a digital signature can send the sign copy of ITR -V Acknowledgment to ” Income Tax Department- CPC, POST BAG NO-1, ELECTRONIC CITY POST OFFICE, BANGALURU-560100, KARNATAKA”. by ORDINARY POST OR SPEED POST ONLY.

CIRCULAR NO. 04/2014 [ F.No.225/198/2013-ITA.II] Dated : February 10, 2014

Relaxation of time limit for filing ITR V: ITR V form for A.Y’s 2009-10, 2010-11 and 2011-12 can be filed till 31.03.2014 for returns e- filed with refund claims within the time allowed u/s 139

Subject – Non-Filing of ITR-V in returns with refund claims-relaxation of time- limit for filing ITR-V and processing of such returns -regarding.

Several instances of grievances have come to the notice of the Board stating that a large number of returns-of-income for Assessment Year (‘AY’) 2009-2010, which were electronically filed without a digital signature in accordance with procedure laid down under the Income-tax Act, 1961(‘Act’), were not processed as such returns became non-est in law in view of Circular No. 3 of 2009 of CBD1 dated 21.05.09. Paragraphs 9 and 10 of the said Circular laid down that ITR-V had to be furnished to the (Centralised Processing Centre (‘CPC’), Bengaluru by post within 30 days from the date of transmitting the data electronically and in case, ITR-V was furnished after the stipulated period or not furnished, it was deemed that such a return was never furnished. It was claimed by some of the taxpayers that despite sending ITR-V through post to CPC within prescribed time-frame, the same probably could not reach CPC and thus such returns became non-est. Since ITR-V was required to be sent through (ordinary) post at a ‘post box’ address, there were no despatch receipts with the concerned senders in support of their claim of having furnished ITR-V to CPC within prescribed time limit.

2. Subsequently CBDT extended the time-limit for filing ITR-V (relating to Income-tax returns filed electronically without digital signature for AY 2009-2010) upto 31..12.2010 or 120 days from the date of filing, whichever was later. It also permitted sending of ITR-V either by ordinary or speed post to the CPC. However, for the AY 2009-10, some cases were still reported where return was declared non-est due to non-receipt of ITR-V by CPC even within such extended time-frame and consequently the refund so arising continue to remain held up.

3. Likewise, for AY’s 2070-11, and 2011-12, though relaxation of time for furnishing ITR-V was granted by Director General of Income Tax (systems), it has been noticed that a large number of such electronically filed returns still remain pending with Income-tax Department for want of receipt of valid ITR-V Certificate at CPC.

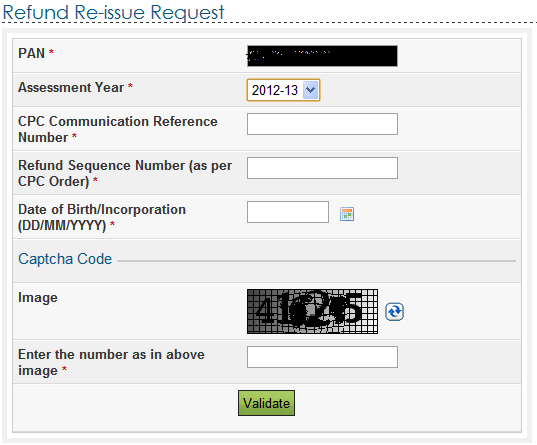

4. The matter has been examined. In order to mitigate the grievances of the taxpayers pertaining to non-receipt of tax refunds, Central Board of Direct Taxes, in exercise of powers under section 119(2)(a) of the Act, hereby further relaxes and extends the date for filing ITR-V Form for Assessment years 2009-10, 2010-11 and 2011-12 till 31.03.2014 for returns e-Filed with refund claims within the time allowed under section 139 of the Act The taxpayer concerned may send a duly signed copy of ITR-V to the CPC by this date by Speed post In such cases, central Board of Direct Taxes also relaxes the time-frame of issuing the intimation as provided in second proviso to sub section (1) of section 143 of the Act and directs that such returns shall be processed within a period of six months from end of the month in which ITR-V is received and the intimation of processing of such returns shall be sent to the assessee concerned as per laid down procedure.

5. Provision of sub-section (2) of section 244A of the Act would apply while determining the interest on such refunds.

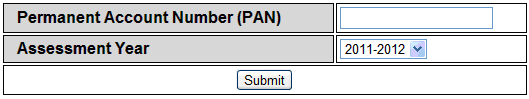

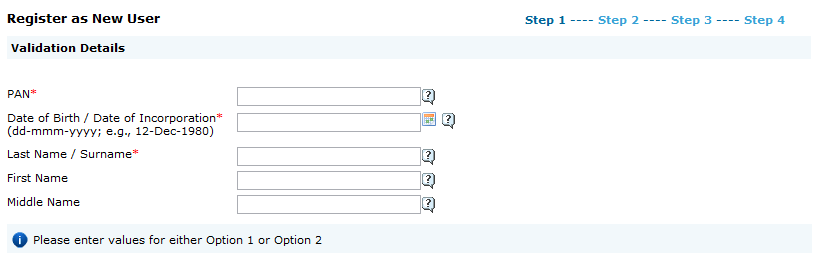

6. The taxpayer concerned may ascertain whether ITR-V has been received in the CPC, Bengaluru or not by logging on the website of Income-tax Department – e-Filing/ Services/ITR-V Receipt Status.html by entering PAN No. and Assessment year or e-Filing Acknowledgement Number. Alternatively’ status of ITR-V could also be ascertained at the above website under ‘Click to view Returns/Forms’ after logging in with registered e-Filing account. In case ITR-V has not been received within the prescribed time’ status will not be displayed and further steps would be required to be taken as mentioned above.