Download Company Law Form FTE: Form No FTE used as an Application for striking off the name of company under the Fast Track Exit (FTE) Mode

How to e-file Form FTE

1.Enter the Corporate Identity Number (CIN) of the company

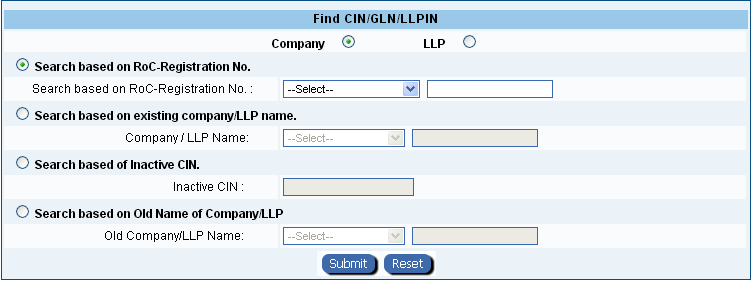

You may find CIN by entering existing registration number or name of the company in the ‘Find CIN/GLN’ service at the MCA21 portal and Find Details of Company CIN, GLN, LLPIN using Name of Company, ROC registration number etc.

2. Click the “Pre-fill” button.

- System will automatically display the name, address of the registered office of the company, email id and date of incorporation of the company. In case there is any change in the email ID, enter the new valid email ID.

- Enter the number of director(s), Managing Director, manager, secretary of the company as on the date of filing the Form. Based on the number entered here, number of blocks shall be displayed for entering the details. Details of maximum of 12 persons can be provided in the eForm. In case number entered is greater than 12, then only 12 blocks shall be displayed.

- It shall be validated that in case there are one or more active signatories existing in the system for the company, then details of all such signatories should be entered.

In case of Director/ Managing Director (Where DIN is available)

- Enter DIN: Status of DIN should be approved

- Ensure that the DIN entered is correct and then click the “Pre-fill” button. System will automatically display the name and present residential address of the person. Verify that the details displayed are correct. In case there is any change in the present residential address, enter the new address. Select the designation of the person.

In case of Director/ Managing Director (Where DIN is not available) and in case of manager, secretary : Enter income-tax PAN or Passport Number in case of Director/Managing Director. In case of Manager or secretary, only Income-tax PAN can be entered. Enter the name, designation and present residential address of the person.

4. Select whether the application is being digitally signed by Managing Director, director, manager or secretary of the company. In case of No, copy of physical application duly signed by the director, Managing Director, manager or secretary is mandatory to attach. It shall be validated that ‘No’ cannot be selected in case there are one or more active signatories existing in the system for the company.

5. Enter the details of assets and liabilities as given in the statement of accounts (As per annexure C of the Guidelines). Field for Secured loans and Public deposits shall be automatically displayed as zero by the system.

Attachments For Dissolution of Company through Fast Track Exit

- A duly certified statement of account by a chartered accountant in whole-time practice or statutory auditor of the company (As per annexure C of the Guidelines) (Mandatory)

- Copy of Board resolution showing authorisation given for filing this application (Mandatory)

- Affidavit (to be given individually by director(s)) (As per annexure A of the Guidelines) (Mandatory)

- Indemnity bond (to be given individually or collectively by director(s) (As per annexure B of the Guidelines) (Mandatory)

- In case application is not digitally signed by the company representative, physical copy of application duly signed by the director, Managing Director, manager or secretary authorised by the Board of Directors (Mandatory in case ‘No’ selected in field 10)

- Copy of no objection certificate (NOC) from concerned administrative Ministry/

- Department/ State Government (Mandatory in case of a Government company)

- Any other information can be provided as an optional attachment

Verification

In case ‘Yes’ is selected in field 10, it is mandatory to enter the serial number and date of board resolution authorising the signatory to sign and submit the eForm.

Signature

In case ‘Yes’ is selected in field 10, eForm should be digitally signed by the following: Managing director or director or manager or secretary of the company authorised by the board of directors.

Designation

- In case ‘Yes’ is selected in field 10-

- Select the designation of the person digitally signing the eForm.

- Enter the DIN in case the person digitally signing the eForm is a director.

- Enter income-tax PAN in case the person signing the eForm is a manager

- Enter membership number or income-tax PAN in case the person digitally signing the eForm is a secretary.

Certification

- The eForm should be certified by a chartered accountant (in whole-time practice) or cost accountant (in whole-time practice) or company secretary (in whole-time practice) by digitally signing the eForm.

- Select the relevant category of the professional and whether he/ she is an associate or fellow.

- In case the professional is a chartered accountant (in whole-time practice) or cost accountant (in whole-time practice), enter the membership number. In case the practicing professional is a company secretary (in whole-time practice), enter the certificate of practice number.

Download Application for striking off the name of company under the Fast Track Exit(FTE) Mode

This movie requires Flash Player 9