Income Tax Demand or Refund is issued once your assessment for that year is completed and Income tax officer i.e. Assessing Officer issues Income Tax Assessment order under section 143 (Summary assessment and Scrutiny assessment), Section 144 (Best judgment assessment), Section 147(Income escaping assessment). But Once Assessment is completed there can three outcome

1. No Demand or Refund for that Assessment Year

2. Refund Issued for that Assessment Year

3. Demand Payable

So Assessee has two option or alternate in relation to that assessment year he accepts it or rejects is in case no acceptable then he can file Appeal Against that Assessment year with Income Tax Appeal with 30 days of receipt of Income tax Assessment order. In case accepts that Assessment order he has the option to pay outstanding Income Tax Demand either online or offline through challan no 280. Basic Information required for Depositing Income Tax Demand or Normal Income Tax is PAN Number and Year for which you want to deposit income tax.

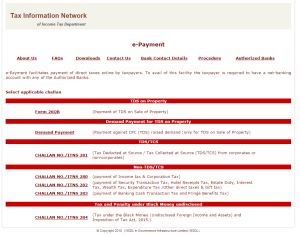

Process for Deposit Online Outstanding Income Tax Demand (Click on Link for Payment of Income Tax ) or Download the Challan No 280

Select Challan No 280 :Payment of Income Tax & Corporation Tax

Tax Applicable: select code 21 for any Person other than Companies

PAN Number:

Assessment for Year: Year for which Demand is Outstanding (Note Asst Year for Financial Year 2011-12 will be 2012-13, 2012-13 will be 2013-14, 2013-14 will be 2014-15 and So on)

Name of Person: As Given on PAN Card (it will be displayed once you fill all details and click on proceed link given at the end of form 280)

Address of the Assessee

Mobile No and Email id

Type Of Payment: Select 400(TAX ON REGULAR ASSESSMENT) for Income Tax Demand Deposit and 300 (SELF ASSESSMENT TAX) for Deposit of Tax Before filing Income tax return after year ending and 100 (ADVANCE TAX) for deposit of Income Tax Before year ending for FY 2015-16 (Assessment Year 2016-17) upto 31st March 2016.

Select Bank: Bank for which Net Banking Facility is activated

Once Proceed is Selected Confirmation Screen will be opened

If All the Details Correct Select Submit to Bank Option.

In Case if Assessee wants to Deposit Income Tax Offline then he can download Challan No 280 and Fill the Above details