Central Board of Direct Taxes has issued the press release and clarified the doubts relating to the extension of time for filing of Tax Audit Report and E-Return filing by the Companies and the Tax Payer required to file return on or before 30th Sept 2015. CBDT has accepted that there was delay in issue of return by 4 months but considering no major changes in the ITR and TAR no extension is required and suggested that tax payer should be file ITR before due date to avoid last minute rush.

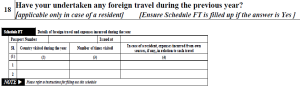

Income-tax returns for Assessment Year 2015-16 for certain categories of assessees viz companies, and firms, individuals engaged in proprietary business/profession etc whose accounts are required to be audited, are to be filed by 30th September, 2015. The audit report is also required to be filed by the said date. The Government has received representations from various stakeholders seeking extension of date for filing of returns and tax audit reports beyond 30th September 2015. The reasons cited are delay in notifying the returns and related delay in availability of forms on the e-filing website. The matter has been considered. Income-tax returns forms 3,4,5,6 and 7 which are used by the above mentioned categories of assessees were notified for Assessment Year 2015-16 on 29.07.2015. The forms were e-enabled and were available on the e-filing website of the Department from 7th August 2015 giving enough time for compliance. The changes made to these forms are not extensive as compared to the earlier years. Further taxpayers entering into either international transactions or specified domestic transactions are required to file their returns by 30th November 2015 only. After consideration of all facts, it has been decided that the last date for filing of returns due by 30th September 2015 will not be extended. Taxpayers are advised to file their returns well in time to avoid last minute rush.