Any person not happy with the decision/order of Income Tax Assessing officer can file the appeal with Income Tax Commissioner (Appeals) using Income Tax Form 35 and depositing the required appeal fees starting from Rs 250/- to Rs 1000/-(Maximum) using Income Tax Challan No.280. Person can file appeal against the orders like Intimation issued under Section 143(1), Rectification Order u/s 154/155 or Order against tax payer where the tax payer denies liability to be assessed under Income Tax Act etc. and If Person is not satisfied with order of commissioner appeal then he file the appeal against it in Income Tax Appellate Tribunal in form 36.Appeal Fees for Income Tax Tribunal is Rs 500/- to Rs 10,000/-(Maximum). Appeal with Commissioner is required to be filed within 30 days from the date of service of an assessment order or penalty order and the appeal with Appellate Tribunal is required to be filed within a period of 60 days from the date of service of order. CIT(A)/ITAT have power to condone delay in filing appeal if he is of the view that there was a reasonable cause for delay in filing the appeal.

Appeal Fee Chart

| S.No |

Total Income determined by the Assessing Officer |

Appeal Fee in Rs. |

| 1 |

Less than Rs. 1,00,000/- |

Rs 250/- |

| 2 |

More than Rs.1,00,000/- but less than Rs.2,00,000/ |

Rs 500/- |

| 3 |

More than Rs. 2,00,000/ |

Rs 1000/- |

| 4 |

Where the subject matter of appeal relates to any other matter |

Rs 250/- |

Download Income Tax Challan for Appeal: Challan 280

Download Income Tax Appeal to CIT(A) Format: Form 35

Download Income Tax Appeal to ITAT Format: Form 36

Aggrieved tax payer can file appeal before the Commissioner (Appeals) having, jurisdiction over the tax payer. Designation of the Commissioner (Appeals), with whom appeal is to be filed is also mentioned in the notice of demand issued by the Assessing Officer under section 156 of Income Tax Act. WHEN APPEAL CAN BE FILED BEFORE COMMISSIONER (APPEALS), i.e. APPEALABLE ORDERS:

Appeal can be filed before Commissioner (Appeals), when a tax payer is adversely affected by Orders as under passed by various Income tax authorities:

(a) Order against tax payer where the tax payer denies liability to be assessed under Income Tax Act;

(b) Intimation issued under Section 143(1) making adjustments to the returned income ;

(c) Scrutiny assessment order u/s 143(3) or an ex-parte assessment .order u/s 144, to object to income determined or loss assessed or tax determined or status under which

assessed,

(d) Order u/s 115WE/115WF/115WG assessing fringe benefits;

(e) Re-assessment order passed after reopening the assessment u/s 147/150;

(f) Search assessment order u/s 153A or 158BC;

(g) Rectification Order u/s 154/155;

(h) Order u/ s 163 treating the taxpayer as agent of a nonresident;

(i) Order passed u/s 170(2)/(3) assessing the successor to the business in respect of income earned by the predecessor;

(j) Order u/s 171 recording finding about partition of Hindu undivided family(HUF);

(k) Order u/s 115VP(3) refusing approval to opt for tonnage-tax scheme by qualifying shipping companies;

(l) Order u/s 201(1)/206C(6A) deeming person responsible for deduction of tax at source as assessee in default on failure to deduct/ collect tax at source or to pay the same to the

Government;

(m) Order determining refund u/s 237;

(n) Order imposing penalty u/s 221/271 /271A/271AAA/271F/271FB/272A/272AA/272BB/ 275(1A)/158BFA(2)/271B/ 271BB/271C/271CA/271D/271E

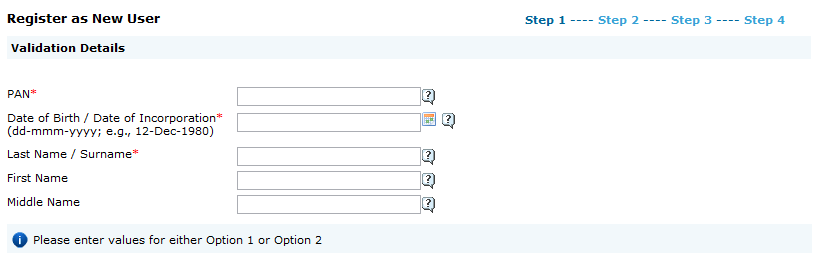

FORM OF APPEAL AND HOW TO FILL THE SAME:

Every appeal to the Commissioner (Appeals) is to be filed in Form No. 35, as per Annexure-1. In this form, details such as name and address of the tax payer, Permanent Account Number (PAN), assessment year, details of the order against which appeal is filed etc. are to be filled in.

Against the column “Relief claimed in appeal”, amount of reductions sought in income or any other relief sought in appeal is to be mentioned.

• In the column “Statement of Facts”, relevant facts in respect of each subject matter of appeal are to be mentioned in brief. Nature of business or profession, account books maintained etc. may also be mentioned in this column.

• Against column “Grounds of appeal”, points on which relief is sought in appeal are to be mentioned in narrative form. For example, in an appeal against addition to the returned

income by applying a gross profit rate on estimated turnover, the ground of appeal may be, “the Ld. Assessing Officer was not justified in rejecting the results as per regular books

of account and in estimating the income by applying an adhoc rate of gross profit.”

WHO HAS TO SIGN FORM No. 35?:

Form no. 35 is to be signed and verified by the individual tax payer himself or by a person duly authorised by him holding valid power of attorney. In case of HUF, Form no. 35 is to be signed by the Karta and in case of a company, by the Managing Director and in case of a firm, by the Managing Partner.

PAYMENT OF ACCEPTED TAX LIABILITY MUST BEFORE FILING APPEAL:

An appeal will be admitted by Commissioner (Appeals) only if tax as per the returned income, where return of income is filed, or advance tax payable, where no return of income is filed has been paid prior to filing of appeal. In the latter situation i.e. where return of income is not filed, tax payer can apply to the Commissioner (Appeals) for exemption from such condition for good and sufficient reasons.

APPEAL FEES:

Fees to be paid before filing appeal to the Commissioner (Appeals) depends upon total income determined by the Assessing Officer. Fees as under are to be paid and proof of payment of fee is to be attached with Form No. 35:

| S.No |

Total Income determined by the Assessing Officer |

Appeal Fee in Rs. |

| 1 |

Less than Rs. 1,00,000/- |

Rs 250/- |

| 2 |

More than Rs.1,00,000/- but less than Rs.2,00,000/ |

Rs 500/- |

| 3 |

More than Rs. 2,00,000/ |

Rs 1000/- |

| 4 |

Where the subject matter of appeal relates to any other matter |

Rs 250/- |

Download Challan For Appeal Fee Payment: Select Option Other Fee in payment Details

BY WHEN CAN APPEAL BE FILED BEFORE COMMISSIONER (APPEALS)?

Appeal is to be filed within 30 days of the date of service of notice of demand relating to assessment or penalty order or the date of service of order sought to be appealed against, as the case may be. The Commissioner (Appeals) may admit an appeal after the expiration of period of 30 days, if he is satisfied that there was sufficient cause for not presenting the appeal within the period of 30 days. Application for condoning the delay citing out reasons for the delay along with necessary evidences should be filed with Form No. 35 at the time of filing of appeal. Commissioner (Appeals) can condone the delay in filing the appeal in genuine cases with a view to dispense substantive justice.

APPEAL PROCEDURE:

On receipt of Form no. 35, Commissioner of Income-tax (Appeals) fixes date and place for hearing the appeal by issuing notice to the tax payer and the Assessing Officer, against whose order appeal is preferred. The tax payer has a right to be heard either personally or through an Authorized Representative. The Commissioner (Appeals) would hear the appeal and may adjourn it from time to time till the hearing is over. During hearing, Commissioner (Appeals) may allow the tax payer to go into additional grounds of appeal, i.e. grounds not specified in the appeal memo, i.e. Form no. 35, on being satisfied that omission of those grounds from the form of appeal was not wilful or unreasonable. Before disposing of any appeal,Commissioner (Appeals) may carry out further enquiry himself or through the Assessing Officer. If such proceedings are conducted through the Assessing officer, the same are generally referred to as remand proceedings.

FILING OF ADDITIONAL EVIDENCE:

During appeal proceedings, the tax payer is not entitled to produce any evidence, whether oral or documentary other than what was already produced before the Assessing Officer. Commissioner (Appeals) would admit additional evidence filed only in following situations:

(a) where the Assessing Officer has refused to admit evidence which ought to have been admitted; or

(b) where the appellant was prevented by sufficient cause from producing the evidence which he was called upon to be produced by the Assessing Officer; or

(c) where the appellant was prevented by sufficient cause from producing before the Assessing Officer any evidence which is relevant to any ground of appeal; or

(d) where the Assessing Officer has made the order appealed against without giving sufficient opportunity to the appellant to adduce evidence relevant to any ground of appeal. Normally, additional evidences are to be accompanied with an application stating the reasons for their admission, after which the Commissioner (Appeals) may admit the same after recording reasons in writing for its admission. Before taking into account the additional evidence filed, Commissioner (Appeals) is to provide reasonable opportunity to the Assessing Officer. For examining the additional evidence or the witness as well as to produce evidences to rebut additional evidences filed by the tax payer