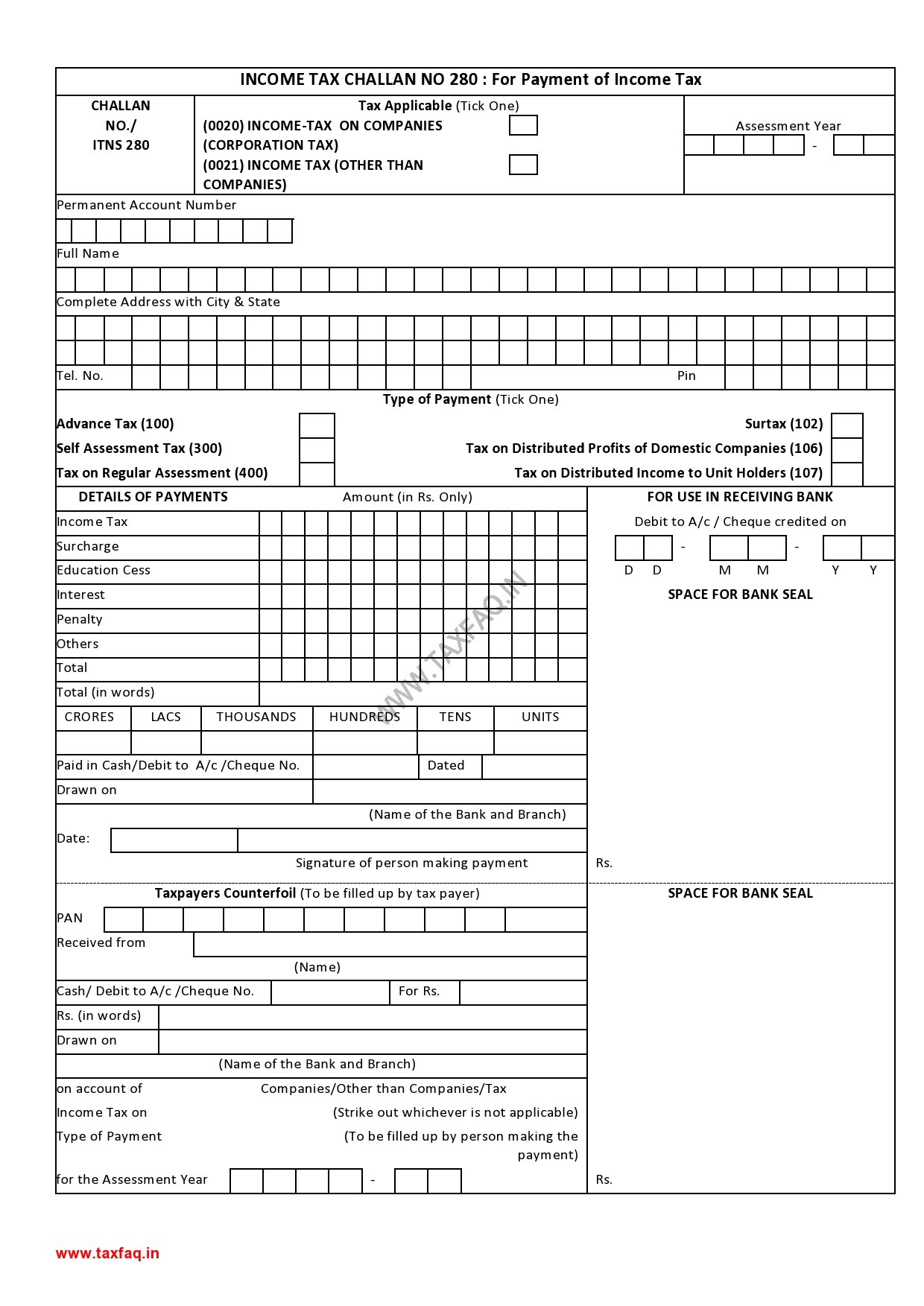

Income Tax Challan No. 280 for payment of Income tax, advance tax, Self Assessment tax by the corporate and non corporate entity. This challan can be used by Individual or Partnership Firm for depositing their Income Tax liabilities. Download Income Tax Challan No 281 for Payment of TDS/TCS

This movie requires Flash Player 9

send self assesment tax challan form

Sir Self Assessment Tax Challan is same Challan for Payment of Income Tax, Download the Challan No 280 and Select the option Type of Payment: Self Assessment (300)

SIR PLEASE LET ME KNOW WHETHER THE INCOME TAX RS.10 DUE CAN BE WAIVED OFF OR DEPOSITED THROUGH CHALLAN BEFORE DUE DATE

For any Income tax Demand of Less than Rs 100/- is not required to be paid and it will adjustred against future refund of assessee

Sir,

I am into a private job and the tax is deducted by my employer. Additionally, i have also shown the interest income from my savings account which was exceeding the stipulated limit for interest income. Please let me know the challan form and major/minor heads that needs to be filled for paying additional tax on this interest income. For your nformation – I paid the additional tax as SAT (minor head 300) and major head as 0024-Interest Tax online but IT is not adjusting this against the interest income

Thanks

I work with IT MNC. I received Form-16 with TDS in salary (Tax Paid) of Rs.88776/- (Net Income Rs78095/-).

I have additional TDS of Rs.2380/- against my FDs in SBI. I saw my bank TDS details in Form-26A (downloaded from TRACES).

Now I want to file IT Returns online by myself, where I need your help.

I used Tax calculator of IT Department given on webpage.

I added total interest (Rs.23701/-) received on FD to recalculate Taxable Net Income which is now Rs.804651/- and web site shown IT on recalculated Net Income is Rs.93658/-

I paid IT in the form of TDS Rs.8876+Rs.2380 = Rs.91156/-

That means I need to pay Rs.2502/- again to file my e-Returns online.

Please guide:

1) Is my above calculation correct and How much amount I need to pay?

2) I tried e-Payment online against Challan ITS 280, where I am confused with some options for selection.

(a) Tax Applicable – (0021)?

(b) Type of Payment : which I have to select from: (100)ADVANCE TAX (102)SURTAX (300)SELF ASSESSMENT TAX (106)TAX ON DISTRIBUTED PROFITS (400)TAX ON REGULAR ASSESSMENT (107)TAX ON DISTRIBUTED INCOME ?

Please guide, so that I can file my e-returns before due date schedule by Government IT Dept.

Thanks and best regards,

Shyam Kumar.