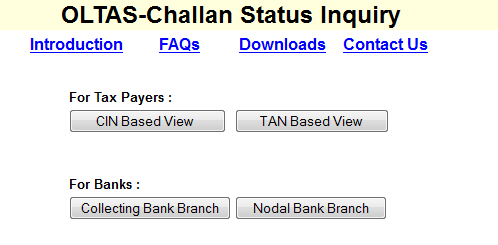

Any one can check the Income Tax, Service Tax, Custom, Central Excise Challan Status using the basic details like

- BSR Code of Collecting Branch

- Challan Tender Date(Cash/Cheque Deposit Date)

- Challan Serial No.

- Amount

Following Details will be generated for the given Income tax Challan

- BSR Code of Collecting Branch

- Challan Tender Date

- Challan Serial No.

- Major Head Code – Income Tax on Companies code 0020 or Income tax Other than Companies code 0021

- Minor Head Code – Advance Tax (100), Surtax (102), Tax On Distributed Profits(106), Self Assessment Tax (300), Tax On Regular Assessment (400)

- Assessment Year: For 2012-13 (2012), For 2013-14(2013), For 2014-15 (2014)

- TAN / PAN: ANYPA1234N(Your 10 digit PAN number)

- Name of Taxpayer

- Received by TIN on: DD-MM-YYYY

- Amount